Top 10 Mortgage Brokers in Logan Qld

A knowledgeable mortgage broker in Logan Qld can simplify home financing, compare lenders, and help you secure a loan that fits your budget and goals. The right broker explains your options, manages the paperwork, and coordinates with agents and underwriters to keep everything on track.

Securing a home loan is one of the biggest financial decisions most people will ever make, and the right mortgage broker can make that process far less overwhelming. In Logan, QLD—an area with a growing population, diverse housing market, and a wide range of buyers from first-home owners to seasoned investors—working with a knowledgeable mortgage broker can help you navigate the lending landscape with confidence. Whether you’re buying your first home, refinancing, or expanding your investment portfolio, a trusted broker brings clarity, options, and often better deals than going it alone.

Mortgage brokers act as your personal guide through the loan process, comparing products from a range of lenders to find one that suits your needs. They assess your financial situation, explain your borrowing power, and handle much of the paperwork and negotiations on your behalf. In a region like Logan, where property prices and loan structures can vary widely, having someone with local market insight and lender relationships is a valuable advantage.

How to Choose the Right Mortgage Brokers in Logan Qld

1. Check their credentials and licensing

Make sure the broker is registered with the Australian Securities and Investments Commission (ASIC) and is a member of industry bodies like the Mortgage & Finance Association of Australia (MFAA) or the Finance Brokers Association of Australia (FBAA). This ensures they adhere to professional standards and ethical practices.

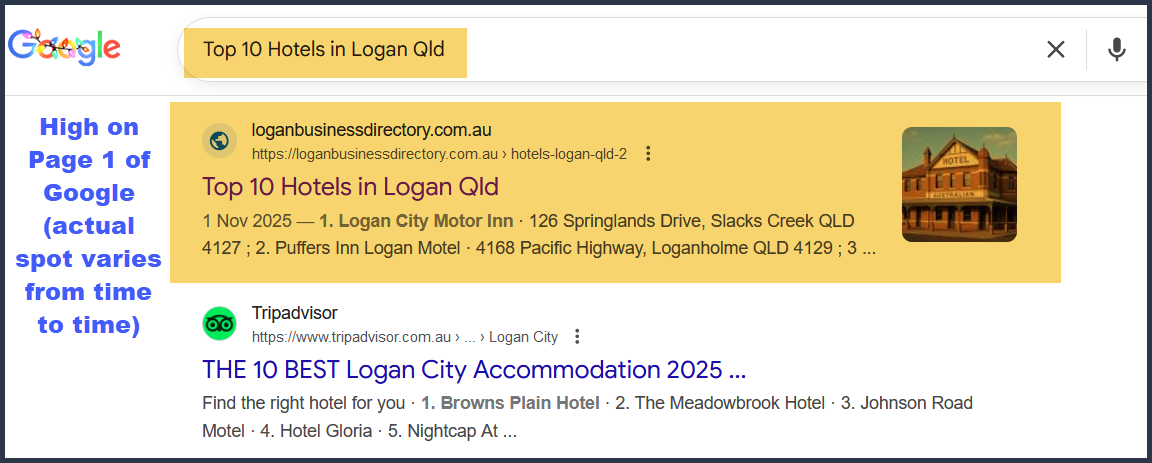

2. Look for local knowledge

A broker familiar with Logan’s property market will understand local trends, council regulations, and which lenders are more flexible with properties in the area. This insight can be crucial when selecting a loan that fits both your property and financial profile.

3. Ask about lender access and loan variety

Some brokers work with a limited panel of lenders, while others offer access to dozens. The more options they have, the better your chances of finding a competitive rate with suitable terms. Don’t be afraid to ask how many lenders they work with and whether they’re independently operated.

4. Evaluate their communication and transparency

Choose someone who takes time to explain your options clearly, answers your questions honestly, and is upfront about fees or commissions. A good broker should feel like a partner in your journey—not a salesperson.

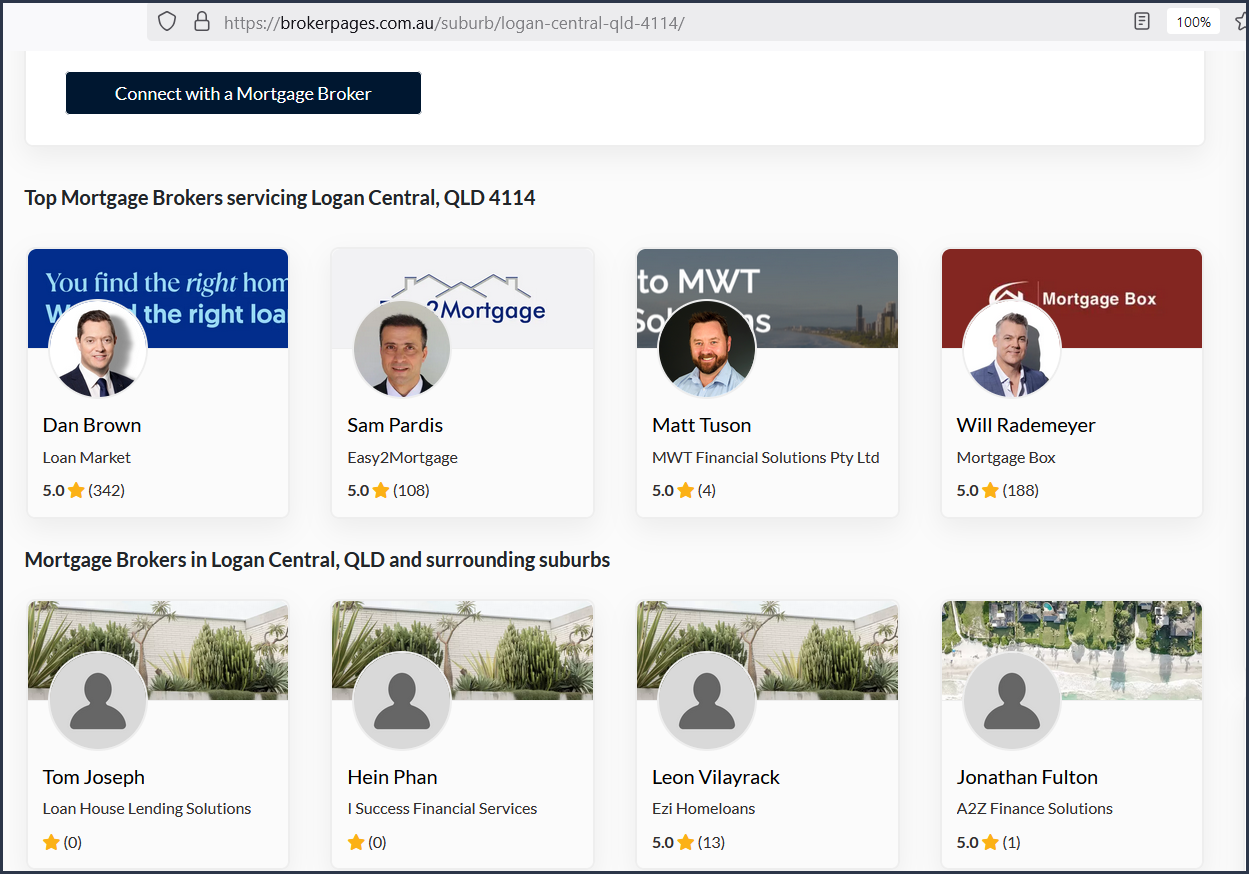

Ready to take the next step towards finding the Best Mortgage Brokers in Logan Qld? Here’s a list of the Top 10 Mortgage Brokers in Logan QLD, each known for exceptional service, local expertise, and a commitment to finding the best loan solutions for their clients.